The ichimoku cloud is an indicator that provides a snapshot of the market trend and can help define support and resistance levels. It can also gauge momentum and provide trading signals. It is a complex indicator, but it can be used in combination with other indicators to enhance its effectiveness.

Developed by Japanese journalist Goichi Hosoda, the Ichimoku is a technical indicator that can be used to identify trend direction, gauge momentum and create potential trading signals.

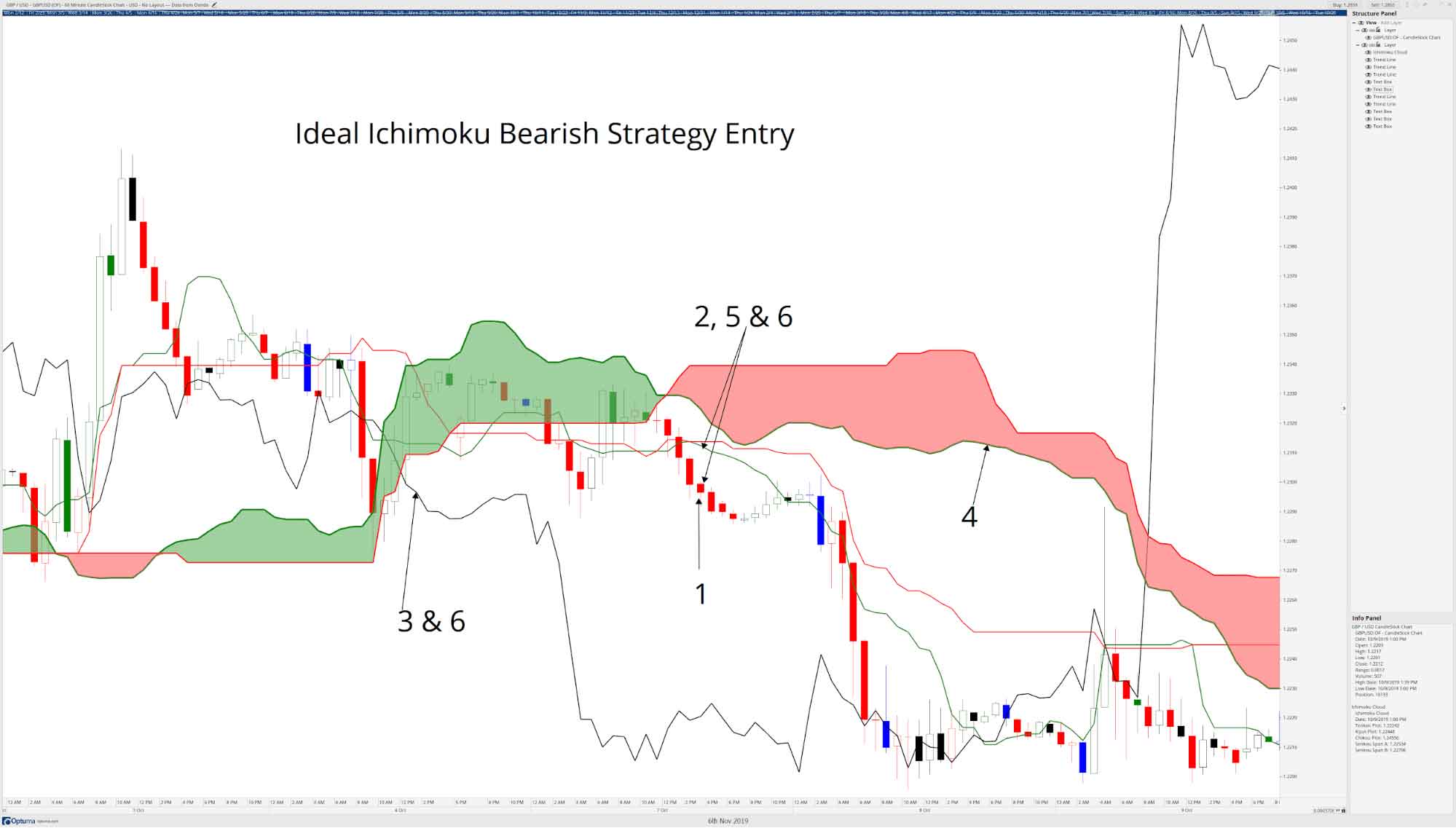

It is a collection of five different lines that are arranged to form a “cloud” on a chart. It is often described as a “one-look equilibrium chart” because it gives traders a picture of the overall market trends at a glance.

To use the Ichimoku, traders should familiarize themselves with its components and how they interact. The Tenkan-sen and Kijun-sen lines can be used to indicate trend direction, while the Ichimoku cloud upper and lower boundaries can be used to identify support and resistance levels.

Also Read: The Role of Dispatching Services in Freight Management and Vehicle Monitoring

The Ichimoku’s fastest moving components – the conversion and base lines – can also be used to provide early momentum signals. The strength of these signals depends on whether they are accompanied by a strong trend.

The Tenkan-sen line, also known as the conversion line, is a fast moving line that serves as an indicator of price momentum. It is calculated by dividing the sum of the last nine candlesticks by two and is used to signal an imminent trend change.

The Kijun-sen line, on the other hand, is a slower moving line that can act as a support or resistance level. It is calculated by adding the highs and lows of the previous nine candles together. The Kijun-sen line is also useful for spotting potential price reversals.

Another important component of the Ichimoku is the lagging span, or Chikou Span. The Chikou Span is the closing price projected 26 periods in the past, and it lags behind the prices of the current period. This allows it to provide forecasting insights that can be used in conjunction with the Tenkan-Kijun cross.

The Ichimoku is a complex indicator that requires a lot of practice to master. It is important to understand each of its components, especially the Span A and Span B lines. Span A is the fastest moving line, while Span B is the slowest. In addition, it is important to know how the Span A and Span B lines are created.

Also Read: Progressive Jackpots – How They Work and Where to Find Them

The calculation of Span A is straightforward, but the calculation of Span B can be more confusing for new traders. The difference between Span A and Span B is reflected in the Ichimoku’s Kumo, which is a contraction of the lagging Span.

0 Comments